The good, bad & ugly: Sectoral impact of GST & what brokerages recommend

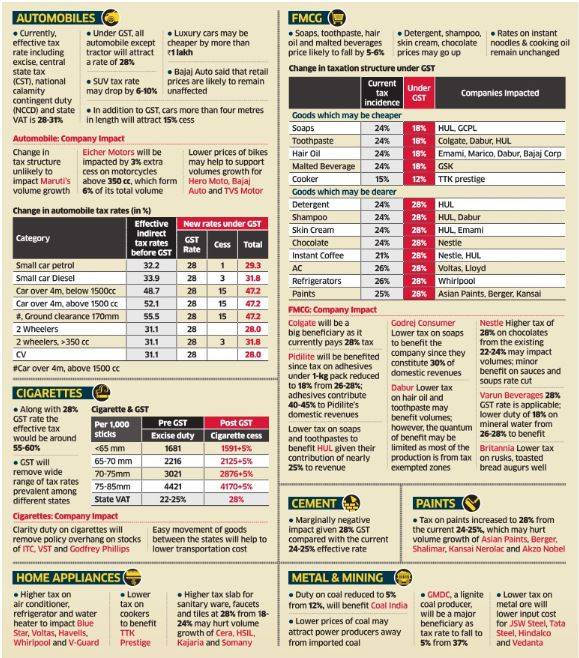

ET Intelligence Group: While the rates prescribed by the Goods and Services Tax (GST) council are a mixed bag for India Inc, some segments such as adhesives, coal and lignite, hair oil, luxury cars, soaps, two-wheelers, and toothpaste are expected to benefit from lower duties. On the other hand, manufacturers of chocolates, paints, sanitary ware and white goods will be adversely affected due to higher taxes. The ET Intelligence Group analyses sector-wise impact of the GST rate structure.

Brokers’ views on stocks

ICICI SECURITIES

HUL: GST implementation would benefi t supply chain efficiency for FMCG companies with the consolidation of storage hubs. Simultaneously, we believe demand shift from un-branded to branded products on the back of level-playing fi eld against unorganised players would also benefi t the largest FMCG company in the country.

ITC: Indirect tax on cigarettes would be largely tax neutral with GST rate at 28% against the average VAT at ~26%. We believe cess of 5% plus specifi c duty would replace central excise. This would make GST on cigarettes largely tax neutral. This would bring relief for ITCBSE 2.82 % considering indirect tax has not been hiked disproportionally.

EDELWEISS BROKING

Heritage Foods: (Dairy industry) Milk has been exempted from GST, while skimmed milk powder has been taxed at a lower rate of 5%, this augurs well for the industry. We are positive on the dairy sector, with Heritage FoodsBSE 1.83 % as our top pick. Target Rs 1,460

Sanghi Industries: Sanghi IndustriesBSE -0.25 % is going to be a huge benefi ciary of GST. SNGI has been using lignite for powerplants and GST rate for lignite is 5% as against the existing rate of 22.5% VAT in Gujarat and excise. The current applicable tax is ~37% which will come down to 5% post GST. We believe this will save ~Rs 420 per tonne to lignite producer. Target: Rs 115

IIFL

Amara RajaBSE -2.03 % Batteries: In a short span since marking its entry in the automotive battery segment (FY01), Amara Raja BatteriesBSE -2.03 % has steadily gained market share and has grown to be the secondlargest battery manufacturer in India after Exide. Post GST, organised sector battery makers like Amara Raja will benefi t. The stock has not run as much as ExideBSE -0.48 %, hence may catch up fast. Target: Rs 1,086

CESC: The demerger of CESCBSE 5.78 % looks clean. The business of the company would be divided into four entities, which would be listed separately. The minority shareholding will remain same as that of CESC. Such segregation would eliminate conglomerate discount and re-rate multiples in each of the businesses. Besides, this sector is likely to benefi t signifi cantly post GST. Target: Rs 1,200

JBF Industries: JBF has commissioned 1.25 million metric tons PTA plant at Mangalore SEZ with a capex of $700 million. This is the second-largest PTA plant in the country (after Reliance Industries) and is likely to ensure a steady supply of PTA for manufacturing of PET chips. Target: Rs 382

MOTILAL OSWAL

Colgate: ColgateBSE 3.59 % pays an effective tax of 25-26% and so 18% tax on toothpastes (80% of sales) is a positive, particularly\ as it levels the playing fi eld against two oral care players DaburBSE 1.12 % and Patanjali who enjoy tax benefi ts. We have a ‘BUY’ rating on Colgate with current target price of Rs 1,180, a 16% upside.

GEOJIT FINANCIAL SERVICES

Dabur: Major segments of Dabur soaps and hair oil fall under lower tax slab of 18% compared to the current effective rate of 26-28%. The largest segment, honey, continues to fall under the exempt category. Dabur can be an indirect benefi ciary if GST helps in bringing down rural infl ation as major consumer staples coming under the exempt category which could impetus to the rural demand.