Government extends deadline for file final GST returns till January 10

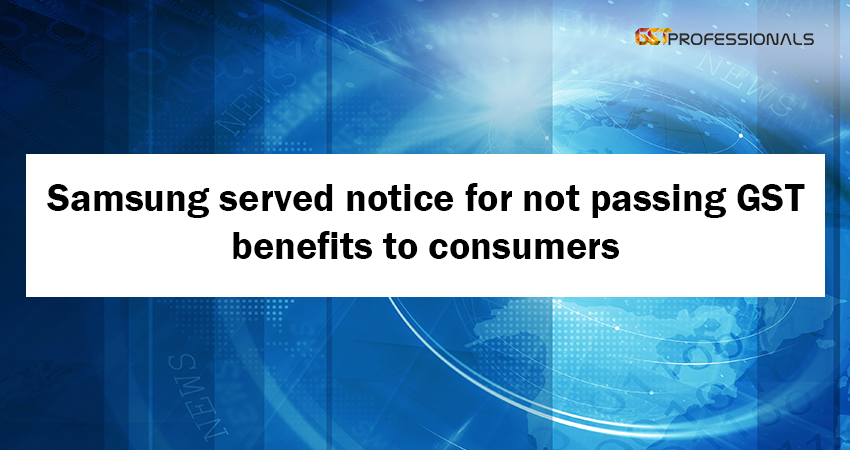

The government has extended the last date for filing of GSTR-1 till January 10, 2018 for businesses with turnover up to Rs. 1.5 crore under GST.

Businesses with turnover of up to Rs 1.5 crore will have to file GSTR-1 for July-September by January 10, 2018, as against December 31, 2017 earlier, said a government press release.

For businesses with turnover of more than Rs 1.5 crore, GSTR-1 has to be filed for the period July-November by January 10.

Earlier these businesses were required to file GSTR-1 return for July-October by December 31 and that for November by January 10.

For the month of December, GSTR-1 is to be filed by February 10 and for subsequent months, it would be 10th day of the succeeding month.

“The due date for filing of monthly GSTR-1 for the period July to November has been extended to 10th Jan. This should bring quite a relief to businesses who have been struggling with system and data issues and file returns,” Abhishek Jain, Tax Partner, EY said in a statement.

The GST Council had in November allowed businesses with turnover of up to Rs 1.5 crore to file final returns GSTR-1 quarterly.

Businesses with turnover of up to Rs 1.5 crore will have to file returns by February 15 for the period October- December and that for January-March by April 30.

Source: www.economictimes.indiatimes.com