GST is the biggest Tax reform India has ever seen since Independence. As per the report by World Bank, the Indian GST system is amongst the most complex in the world. This essentiates the simplified and yet comprehensive understanding of this complex law so that all the interpretations and compliances are known and properly fulfilled by the assessee to create compliant tax structure.

The book is written in a simple language viz-a-viz analyzing the bare provisions of the law that will suit the requirements of all professionals and will give them deep understanding of GST law. It is an attempt to provide professionals with an in-depth analysis of crucial aspects of this law through a simplified approach. The book not only focuses on the professionals like CA/CS/CWA/LLB, but is also a helping guide for all the taxpayers & businessmen’s enabling them to maintain a compliant and hassle free tax structure.

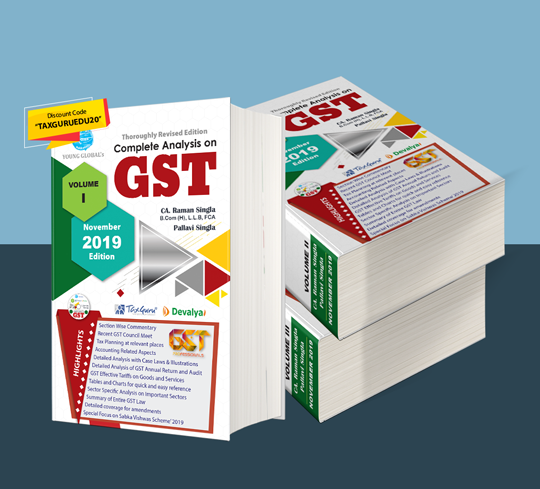

In order to enhance the user reading experience, the book “Complete Analysis on GST”, 2019 Edition is divided into three volumes and nine parts.

1. Volume I contains:

• Part A – Law & Procedure

2. Volume II contains:

• Part B – GST Effective Tariffs

• Part C – GST Annual Return and GST Audit

• Part D – Sectors Specific Analysis

• Part E – Sabka Vishwas (Legacy dispute Resolution) Scheme’ 2019

• Part F – Goods & Services Tax – Statutory Provisions

3. Volume III contains:

• Part G – Summary of GST Law

• Part H – Goods & Services Tax – Statutory Provisions & Clarifications

• Part I – Goods & Services Tax – Provisions continued (in CD)

Reviews

There are no reviews yet.